Difference between EDI 820 and 823:

In general EDI 820 formats will be used to send information to Vendor furnishing details of payment for his supplies. From business standpoint, EDI 820 information comes from customer as the business is vendor to its customer. In fact EDI 820 is not a lockbox format but can be used in place of lockbox for customer open item processing. This information however is not a real payment but only a remittance advice.

Where as lockbox format is an exclusive format that comes from bank confirming the payments received from customer. This is real payment information which got credited in business account at Lockbox /Bank. Besides this basic difference between these two formats some other differences can be summarized as under.

- EDI 820 will have one to one information. Each customer will send remittance information to the business. EDI 823 format will have several customer information in one format.

- Customer can not use EDI 823 format where as Bank can use EDI 820 format.

- EDI 820 is only an advice but 823 is a payment.

- Technical settings viz., Partner profiles, Basic type, Message type, function modules used in SAP are different between these two.

- Level of information will be different. EDI 823 will have Total number of checks involved, total payment amount involved, break up of checks and amount per batch, per customer etc will not be available in case of EDI 820.

Both the formats are acceptable and can be used in SAP for processing customer open items. However the earlier one is (BAI) is file based and the later format is (EDI) is idoc based. File based is batch mode and EDI is real time information. BAI can not be made as real time process but EDI can be made as batch process.

EDI technology requires mapping tool. It creates intermediate document holding the information for further process. On the other side BAI format doesn’t require this.

As far as processing and of clearing customer open items in SAP is concerned, whether the format is BAI or EDI system will follow same transactions. FB01 > FBE1 > FB05. In either of the case if information is not sufficient to clear open items, it is available for manual process.

Some additional advantages of EDI are:

- Data Accuracy

- Reduce Technical Complexity.

- Lowe Personnel needs.

- Accelerates information exchange.

LOCKBOX PROCESS - DATA FILE TO SAP OPEN ITEM CLEARING

| What Bank will do? | Bank Receives the payments, create a data file of the customer remittance information and payment amounts, and deposit the checks into client bank account. On regular basis, Client company receives this data file for processing to update in their accounts. |

| What lockbox data file contain? | Depending upon the choice of services with the Bank, the lock box file will contain information viz., Customer name, Customer Number, Customer MICR number ( Bank routing and Account Number), Check amount, Invoice number, Payment date, Payment amounts and other information. |

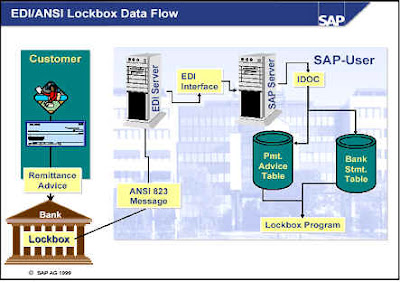

| Lockbox Data Flow | As shown in the following picture, customers send their payments to a lockbox. Then bank collects the data and sends (either through EDI 820 and 823 formats) to R/3 users EDI server (standard Process). The server translates the message using as standard EDI interface into an IDOC (Intermediary documents) and sends it to the SAP Server. |

| What happens in SAP server | Once the message is received and stored in SAP table, a program is clicked (RFEBLB30 or FLBP transaction) to check the information stored in bank statement tables and create payment advices with Payment amount, invoice numbers and customer number. |

No comments:

Post a Comment